Pledges for climate resilience are rising. Communities still ask the same question: when does the funding arrive, and what changes on the ground. We follow three live channels of money and ideas; Africa’s adaptation push, the new Loss and Damage fund, and a regional partnership in Asia, to see what is moving, where it sticks, and how to judge progress this year.

The promise and the pinch

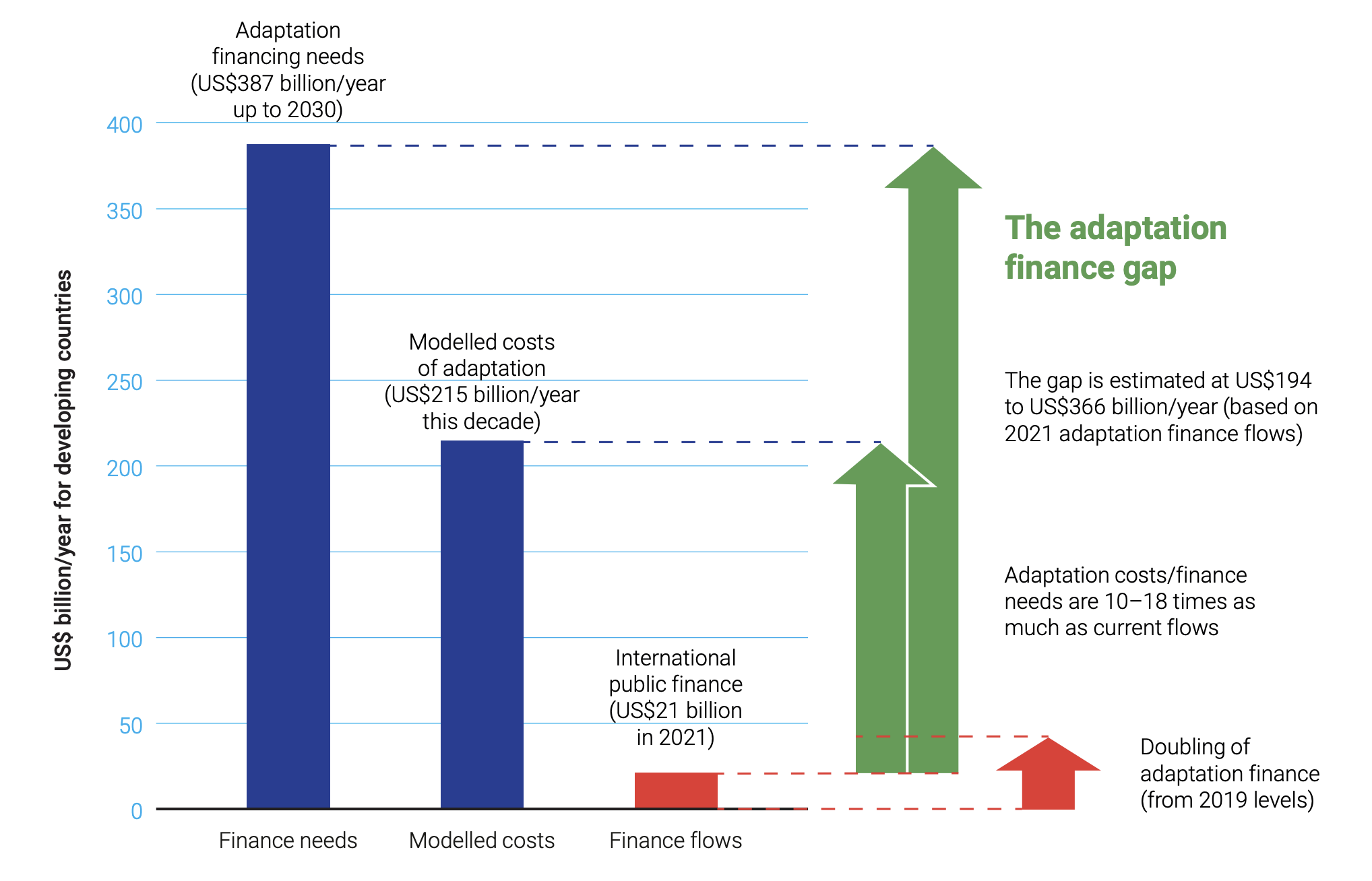

The logic of adaptation finance is simple. Countries hit first and hardest by heat, storms and floods need steady support to protect lives and keep economies moving. The practice is messier. Funding leaves a donor ledger, pauses in trust accounts, and moves through banks and programmes before a borehole is sunk or an early warning siren works. Deadlines slip. Interest fades. People wait.

Africa is trying to cut through that drift with a plan that blends policy and projects. The Africa Adaptation Acceleration Programme, a joint effort of the Global Center on Adaptation and the African Development Bank, was set up to mobilise tens of billions of dollars and to pull adaptation into real investment decisions. Its brief is unambiguous: move funding at scale into food systems, infrastructure, youth enterprise and digital services for farmers.

In September 2025 the programme’s backers outlined a new phase, framed as a blueprint for a resilient Africa, with a stronger tilt to country ownership and delivery systems that last beyond donor cycles. The timing matters. The next United Nations climate summit will judge progress not by speeches but by faster approvals and projects that people can visit and verify.

At the same time, a new pot of funding; the Fund for Responding to Loss and Damage is finding its feet. By mid 2025, publicly tracked pledges were just under eight hundred million dollars, with the World Bank serving as interim trustee while the fund sets up its own systems. Leadership and hosting have been agreed. Attention now turns to how quickly the first grants reach those facing irretrievable losses after storms, floods and slow onset change.

A third story is playing out in Asia. A regional effort led by Singapore’s central bank has completed a first close for a partnership to finance green infrastructure, with a manager mandated to support projects that are viable but struggle to secure backing.

The Green Investment Partnership has about five hundred and ten million dollars committed and is lining up clean power, storage, cleaner transport and circular economy projects across the region, aiming to show that concessional capital can draw commercial money into useful deals.

Together these three channels set the tests for the year ahead: predictable cash flows, quick but careful selection, and frank reporting on what changed.

What is moving in Africa

The adaptation programme’s record is spread across many sectors, but the core idea is to bring technical help and policy fixes early, so that banks and governments can approve projects that stand up to climate stress. Public material frames a target of about twenty five billion dollars mobilised within five years, with four pillars that map to food, infrastructure, jobs and digital services. It is not a single fund. It is a way to turn plans into bankable work and to steer large lenders towards climate smart choices.

What should readers watch now. First, the link between country plans and actual approvals. Second, early wins that can be copied. For Kenya, recent proposals to the Adaptation Fund emphasise early warning systems for floods and drought, integrated with national hydromet priorities and county planning. This is the sort of investment that should move faster if upstream support and country systems are working well.

For Ghana, the most visible near term gains are in agriculture and local infrastructure. Independent studies show that digital advice and climate smart choices are spreading but uneven, with funding, time and training still the main barriers. That is where the programme’s focus on digital services and finance can help, if approvals turn quickly and if local institutions are equipped to manage the spend.

Across these examples the mark of success is not a new acronym but a short chain from plan to contract. Expect to see this in the months ahead: firm dates for approvals, a named contractor or public agency for each component, and a first list of assets delivered; weather stations, flood defences, climate smart seed distribution, feeder roads built to updated standards.

Loss and Damage

The new fund for loss and damage carries heavy expectations. It exists to support responses where adaptation cannot fully protect lives and livelihoods, or where the harm has already occurred.

Recorded pledges are modest against the losses seen after cyclones or long droughts, but the fund can still prove a model for quick and fair delivery, if it shows where the funding went and who decided. The public will want to see a simple ledger of pledges, money received, grants approved, and a date by which recipients can expect disbursement.

For governments and agencies the practical question is whether loss and damage grants will work alongside existing adaptation plans without creating new hoops to jump. Early coordination with disaster agencies and social protection systems will matter as much as the size of the envelopes.

Asia’s test case for blended capital

In Asia, Singapore’s central bank has helped seed a regional partnership to finance green infrastructure. The first close of the Green Investment Partnership brought in about five hundred and ten million dollars from a mix of public and private sources, with a manager tasked to support solar, storage, cleaner transport and circular economy projects that are useful but marginal for banks. The managing platform, created by a bank and a state investor, is meant to line up public and private funding without drowning the deal in paperwork.

Why it matters for African readers: it offers a model African institutions want to see, with public funding taking a defined share of risk, private lenders and developers following behind, and standard reports on what was built and what was avoided in emissions. If the partnership publishes a short list of projects with dates, amounts and outcomes, such as households connected, storage built and diesel generators replaced, it will set a benchmark others, including African funds, can follow.

Three country snapshots readers can track

Ghana. Watch agriculture and local infrastructure approvals. Are climate smart seeds, advisory services and rural works moving from plan to contract. Are ministries publishing delivery schedules and unit costs. Independent work on digital advice and climate smart choices shows promise but also gaps in funding and training. Delivery will depend on how quickly national systems can manage funds linked to clear standards.

Kenya. A live proposal for early warning, water access and resilience in the Ewaso Nyiro basin shows what is on the table: better hydromet data, clearer alerts, and more reliable services for communities at risk. The test is the familiar one: approval date, contracting date, and the first time a new alert system is shown to work during a storm.

Bangladesh. New proposals and studies point to the scale of loss and damage in coastal districts and the need to harden shelters, protect water sources and improve warnings that reach women and the most vulnerable. Where grants are approved, readers should look for public criteria and a fast route to cash in hand for those who need to rebuild.

How to judge progress this year

Follow the time. Every story of success in adaptation has dates you can check: when a proposal was filed, when it was approved, when a contractor was hired, when the first asset was in place, and when the first public report came out.

Follow the numbers. For each programme, match three simple figures: funding pledged, funding released and things delivered. For the loss and damage fund, you now need to see grants approved and dates for payments. For Africa’s adaptation plan, ask ministries for project lists by sector. For the Asia partnership, ask the manager to publish a short table of deals.

Follow the rules. Cheap projects can still harm people if standards are weak. Our international desk reported that poor ventilation and dirty wastewater in textile hubs were linked to illness and river pollution. This is not a case against recycling or industry. It is a reminder that basic protections, clean air at work, protective gear people can use, working wastewater treatment, and clear fibre labels, must be part of any plan that calls itself climate action.

What to watch next

A public note from the adaptation programme setting out concrete country pipelines before the next summit, with numbers that citizens and journalists can verify.

A first set of grants announced by the loss and damage fund, with country windows and clear timelines to payment.

A first slate of projects from the Asia partnership, with a one page fact sheet for each deal: date, amount, expected impact and the public body or company responsible.

Sources:

Global Center on Adaptation and African Development Bank briefings; UN fund documents for Loss and Damage; Monetary Authority of Singapore and manager releases on the Green Investment Partnership; Adaptation Fund proposals and national ministry updates for Ghana, Kenya and Bangladesh; newsroom reporting from Panipat.

Source: www.climatewatchonline.com